The Floral Supply Chain: Cold, Competitive, Consolidating

A florist shop today is a risky enterprise, highly dependent on holiday sales. In the United States, Valentine’s Day alone generates 40 percent of holiday revenues, with sales compressed into a few days, florists must have a plan of attack to survive. They need to be flexible to scale up their business to accommodate holiday sales, while still keeping their business afloat in the off seasons. Still, even with the best of plans, there are many possible pitfalls.

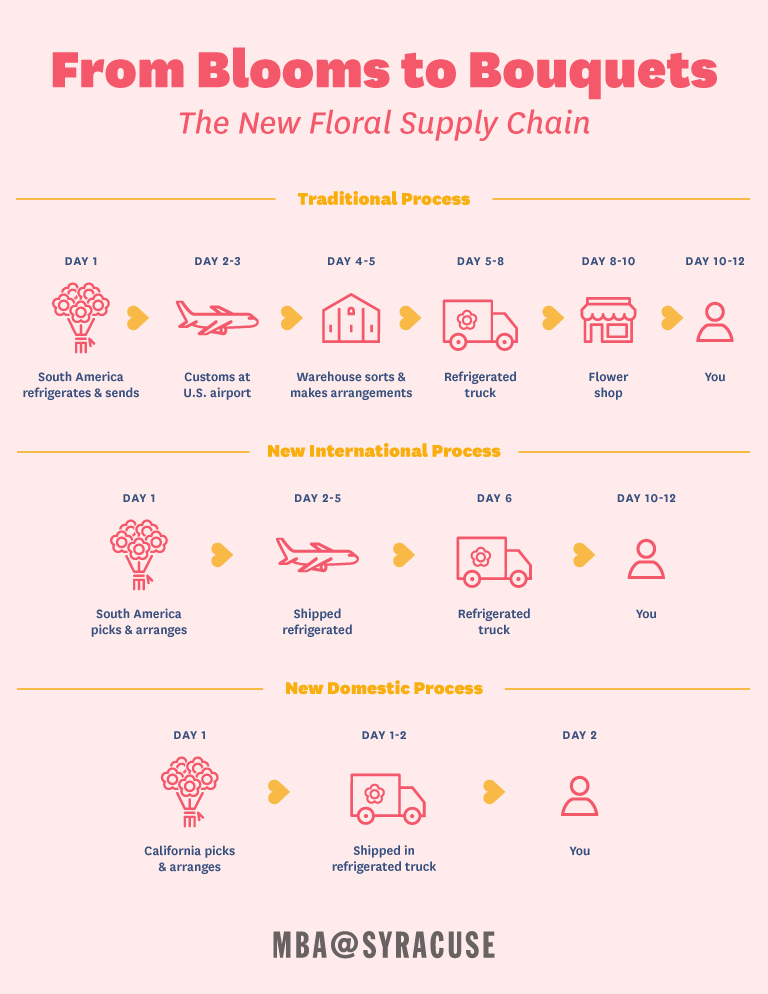

The rush to innovate delivery methods is in constant demand and florists face no exception. Until very recently, traditional delivery practices hadn’t seen much change. With a changing market and new technology emerging, companies are working to cut down on the complicated and antiquated floral supply chain.

High Stakes

The timing of Valentine’s Day means that winter weather is a perennial threat. A 2014 snowstorm blanketed the East Coast, hampering sales and deliveries, many made by temporary workers, relatives, and friends pressed into service for such occasions. And should another 30-plus inches of snowfall take the East Coast by storm as it did in January of 2016, Valentine’s Day flower sales and deliveries could significantly decrease.

Roses — about 257 million in 2014 — account for more than half of the flowers sold for Valentine’s Day, but the demand surge can cause wholesale prices to double. Floral holidays strain the capacity of temperature-controlled transporters, forcing volume onto carriers that may have inferior equipment, slower schedules, and less experience handling flowers. When planning ahead, it’s crucial to have an accurate estimate of demand. Ordering too much inventory leaves a florist watching money wilt, but too little risks squandering a prime selling opportunity.

Florists estimate demand from sales history, factoring in whether or not the holiday falls on a weekend. That can lower demand by about 20 percent because the main customers—men—have more time to plan alternate gifts. Sixty percent of men buy flowers for Valentine’s Day, but only 30 percent visit florist shops. Grocers, discounters, and online sellers capture the rest, a decades-long trend that has shifted two-thirds of flower sales to these outlets.

Lost volume is exacerbated by shrinking profit margins. Today, online delivery services like 1-800-FLOWERS and Teleflora dominate, sending orders to local florists for fulfillment, while pocketing profits the florist shops previously enjoyed. It’s no wonder that florist shops are disappearing. In 2012, the Census Bureau listed 14,344 florist shops in the United States, down from around 27,000 in 1992.

Cold Chain

Retailers want to receive cut flowers as soon as possible after harvest to lengthen vase life, raise customer satisfaction, and spur repeat sales. Temperature-controlled transportation, handling and storage, a “cold chain” in logistics parlance, makes longer supply chains possible, but the time limit still maxes out at about 12 days. Cold chain integrity is critical for imports, which account for 64 percent of U.S. cut flower sales. Ninety-three percent of these imports come from Colombia (78 percent) and Ecuador (15 percent).

About 85 percent of cut flower imports enter the U.S. through Miami International Airport, where an extensive cold-chain infrastructure facilitates around-the-clock customs inspections, fumigation, and distribution among domestic carriers. Customs and Border Protection agents, working in chilled rooms, processed about 801 million cut flower stems during the 2014 Valentine’s Day season.

On average, seven flights dedicated to flowers arrive daily, six days per week, from Latin America. Daily flights swell to 35 during peak season, from January 21 to February 8. To manage the volume, border agents authorize air carriers to process entire planeloads as single shipments, consolidating the paperwork of 30 to 40 brokers and importers.

California supplies three-quarters of domestic production, but the number of farms is half what it was in the 1990s. To compete with cheaper imports, California growers focus on species that Colombia cannot grow or cannot survive air shipping. Still, freight costs make it hard to compete on the East Coast. In 2011, a 16,000-square-foot cold storage warehouse opened next to Los Angeles International Airport, bringing Latin American flower imports to the West Coast.

Sea Change

Passenger airlines earn incremental revenues (2 to 5 percent) carrying cargo alongside luggage, but they illustrate some reasons why the flower industry is moving toward integrated and dedicated supply chains. There are more passenger flights than cargo flights, but they are also more likely to be canceled or rescheduled. And each time custody passes from one company or mode to another, the handoff brings risks, such as containers sitting for long periods on a hot tarmac.

Experts see a growing shift toward cut flower transport by sea, which is about half the cost of airfreight. Enabling this cost-saving shift are improved containers with better control of temperature, humidity, and ventilation and greater availability of refrigerated facilities near ports.

Innovation In Supply Chain

New entrants continue searching for niches in the changing landscape. Startups differentiate along the lines of craft brewers and artisanal foodies. Some wrap bouquets in burlap rather than cellophane. Petal by Pedal, in New York City, and Flowers for Dreams, in Chicago, deliver by bicycle. UrbanStems, in Washington, D.C., Manhattan, Brooklyn, and Queens, “curates” limited selections to avoid spoilage and keep prices low. H.Bloom focuses on corporate subscriptions.

As the industry becomes more global and competitive, dedicated supply chains will become more important to control risks associated with availability, quality, ethical concerns, and price. A single, strong “facilitator” is needed to make such a supply chain function smoothly; those with many intermediaries are becoming “outmoded.”

Such facilitators are sprouting up. In 2014, The Bouqs Company presented their new supply chain model on “Shark Tank.” By employing a direct-to-customer supply chain, they are able to cut costs and delivery time. This model allows suppliers to only cut flowers they use and arrange them on site, saving time and eliminating waste.

For most customers purchasing roses for Valentine’s Day, these supply chain developments remain invisible, but for those inside the floriculture industry, the cycle of growth, maturity, decline, and replacement by new hybrid players continues to resemble the nature of flowers themselves.